Perspectives | 15 June 2017

Measuring banking risks is a difficult exercise, but striking a balance between simplistic and overly complex measurement techniques is the key to accurate risk measurement. This was the substance of the European Central Bank’s (ECB) Chair of the Supervisory Board, Danièle Nouy, in a speech at the Austrian Chamber of Commerce in Vienna, on 2nd May 2017[1].

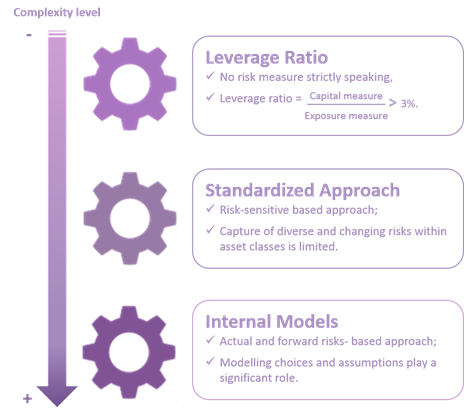

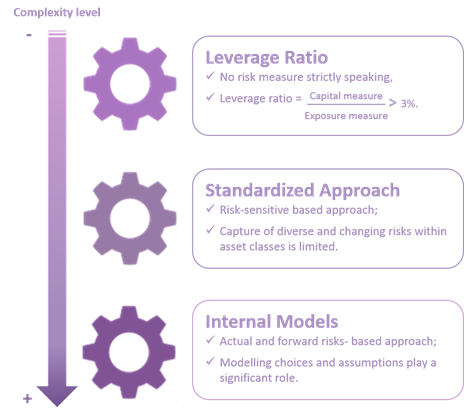

Common approaches used by banks to measure risks include leverage ratio, standardized approach and internal models (see chart – source: Mazars).

In the past, it has been proven that overly simplistic approaches fail to measure risks accurately, while excessively complex ones may lead to risk measurement that is driven by modelling choices rather than by the risks themselves.

For risks whose modeling proves to be difficult, if not impossible, regulatory safeguards have become indispensable to mitigate any significant underestimation of risks. Leverage ratio is one of these regulatory safeguards and the possibility to implement an output floor is being discussed for internal models used to estimate risk weightings (Basel III).

In this perspective, the ECB has launched its second largest project since the 2014 Comprehensive Assessment: The Targeted Review of Internal Models (TRIM).

TRIM aims to restore Credibility, confirm Adequacy and ensure Appropriateness of Pillar I internal Models.

The ECB published the Guide to TRIM on the 28th February 2017[2]. TRIM on-site assessments have just started and the review is expected to be finalised in 2019. The review will be carried out in 68 banks and will assess internal models used to measure:

- Credit Risk with a focus on SME and retail portfolios in 2017

- Market Risk – all models except Credit Risk Mitigation (CRM)

- Counterparty Credit Risk – All but Credit Valuation Adjustment (CVA)

Is TRIM a first step towards the end of internal models?

Difficult to say just yet… but it will clearly put limits on the uses of internal models.

The path towards regulatory compliance regarding internal model management will be all the more difficult as TRIM comes at a time when new European regulatory standards such as BCBS 239, FRTB, SA-CCR, IM/VM., MiFID II, are being implemented by financial institutions..

Strong interdependencies appear among these new requirements. Banks will have to fully identify and understand these interdependencies in order to come up with optimized solutions in terms of governance, data management, information systems, processes and, more generally, in terms of a risk management framework. Beyond the European regulatory standards, compliance with other regulators’ requirements is also at stake, especially regarding USA standards as the FED tends to be more stringent. Regulations are different and so are the requirements banks have to comply with, thus increasing the complexity of regulatory implementation.

The stated objective by TRIM and Basel III Banks is to restore the confidence in internal models and in risk measurements generally speaking. That reminds us of the 2014 Comprehensive Assessment which included the Asset Quality Review and succeeded in proving the soundness and robustness of the European banks and financial system. But, TRIM has just started and its outcome remains uncertain. Future of internal models might just as well be at stake.

One thing is for sure: banks have no other choice than to get prepared and be reactive, in order to finally be compliant and prove their trustworthiness.

[1] https://www.bankingsupervision.europa.eu/press/speeches/date/2017/html/ssm.sp170502.en.html

[2] https://www.bankingsupervision.europa.eu/ecb/pub/pdf/trim_guide.en.pdf