Perspectives | 28 March 2019

On March 11 and 12, 2019, Mazars attended the 30th annual conference organized by the Institute of International Bankers (IIB).

Agencies and regulators serving as speakers and panelists this year, included:

•The Federal Reserve Board (FRB)

•The Department of the Treasury

•The Commodity Futures Trading Commission (CFTC)

•The Securities and Exchanges Commission (SEC)

•The Office of the Comptroller of the Currency (OCC)

•The Federal Deposit Insurance Corporation (FDIC)

•The New York State Department of Financial Services (NYSDFS)

Valuable insights were shared on topics including the LIBOR transition, crypto-currency regulation, and the controversial base erosion and anti-abuse tax (BEAT) enacted in 2017 as part of the Tax Cuts and Jobs Act. However, three items dominated the thought-share.

Preparation for Brexit

There is much confusion around the official date of Brexit. On March 14, Parliament voted to request an extension beyond the original date of March 29, 2019. Then, at the March 21 European Summit in Brussels, it was agreed that Brexit would occur on either April 12 or May 22 depending on the outcome of a new vote on Theresa May’s deal.

CFTC Chairman Christopher Giancarlo reminded IIB conference participants of the task force put in place a year ago to prepare for the disruption in the derivatives trading market. Collectively, the US and UK derivatives markets represent more than 75% of derivative deals. In order to ease the transition, the Bank of England, the Financial Conduct Authority and the CFTC have been working together towards an updated agreement between the two countries to duplicate the relief granted by the US to the EU. The Chairman noted that this preparation is in line with the ideas in the white paper “Cross-Border Swaps Regulation Version 2.0: A Risk-Based Approach with Deference to Comparable Non-U.S. Regulation,” released in October 2018. This approach is supported by the IIB, as emphasized by IIB Chief Executive Officer Briget Polichene, during her introduction to the conference.

Proposals based on the white paper should be issued in the coming months, so stay tuned!

Tailored application of the Bipartisan banking bill to Foreign Banking Organizations (FBOs)

In May 2018, the Economic Growth, Regulatory Relief, and Consumer Protection Act (EGRRCPA) became law.

One of its key provisions an increase to the $50 billion of total consolidated assets threshold, as defined in the Dodd-Franck Act for the application of the Enhanced Prudential Standards (EPS), as Capital Planning and Stress Testing, Resolution Planning or Single-Counterparty Credit Limits.

You can view a summary of the EGRRCPA here.

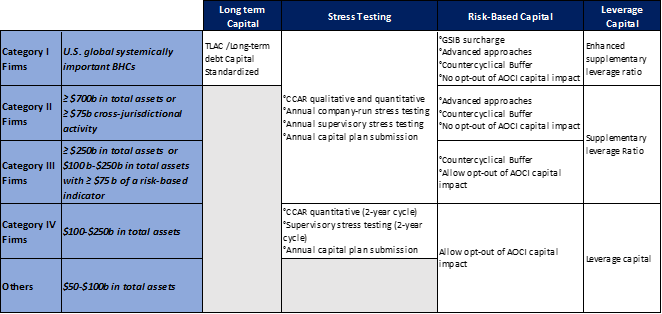

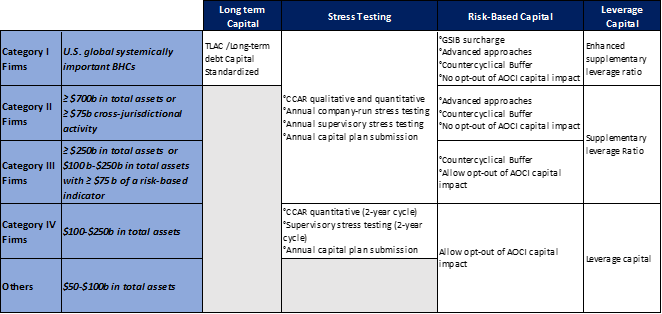

In October 2018, the FRB proposed prudential standards for large US banking organizations (consistent with section 401 of the EGRRCPA), and defining 4 categories with specific proposed requirements:

Capital requirements

Source: Appendix to the Board of Governors of the Federal Reserve System’s meeting held on October 24, 2018 – “Notices of proposed rulemaking to tailor prudential standards”

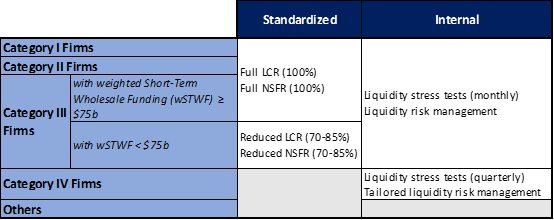

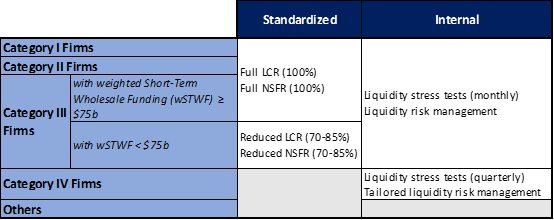

Liquidity Requirements

Source: Appendix to the Board of Governors of the Federal Reserve System’s meeting held on October 24, 2018 – “Notices of proposed rulemaking to tailor prudential standards”

The proposal would not apply to foreign banking organizations (FBOs). However, it was anticipated that an additional proposal from the FRB would cover FBOs, and International banks are seeking more information on how this change would apply to them.

What has been confirmed so far is that the tailored approach will consider size, business model, and risk profile of the US operations of the institution, rather than being based on global consolidated assets. This was a recommendation from the Department of Treasury to the FRB.

Proposed EPS requirement for FBOs are expected to be announced soon.

Volcker Rule 2.0

Section 619 of the Dodd Frank Wall Street Reform and Consumer Protection Act (the “Volcker rule”) was re-proposed in May 2018 and is rumored to be changing significantly in the near-term. Craig Phillips, Counselor to the Secretary Department of the Treasury, stated that the Department is looking forward to “calibrating” the Volcker rule and noted that it might be “re-done.” The changes are expected to be favorable for institutions both in terms of approach to interpretation of the rule and ensuring that the rule is clear between proprietary activity and market-making activity.

Conclusion

Many legislative decisions are expected for 2019. One key point referenced by most regulators: the goal of working together and considering international regulatory requirements when applying rules, which should lighten the regulatory burden and confusion for financial institutions in the coming years, particularly for FBOs.