Perspectives | 7 March 2019

Could the transition period towards the new alternative Risk-Free Rates (RFRs) be more complex than initially envisaged? The speech given by Edwin Schooling Latter, Director of Markets and Wholesale Policy at the Financial Conduct Authority (FCA), on the 28 January 2019, suggests this might be the case.

While Mr Latter re-affirmed that the key focus should not be on whether the London Inter-bank Offered Rate (LIBOR) will end but how it will end, he also set the cat among the pigeons by acknowledging that LIBOR’s continued publication could be envisaged to avoid disruption in cash markets – namely, the bonds and loans markets.

The suggestion opens the door to a new scenario that perhaps financial institutions had not yet taken into account: keeping the LIBOR alive for some legacy instruments highly LIBOR-dependent. Such a path clearly raises a number of questions, in particular when transactions are hedged with derivative contracts. Should those derivative contracts also be treated as an exemption and keep referencing the existing benchmark rates in order to avoid hedging mismatch and breach of the accounting hedging strategies? The possibility, if implemented, implies additional accounting, operational and valuation issues. Banks will need to manage multiple interest rate curves in their system; calculation of valuation adjustments (XVA) can become tricky as derivative contracts within the same netting set won’t reference the same benchmark. In addition hedge ineffectiveness, observability and liquidity issues might also increase.

With the avoidance of disruption in the financial markets a top priority, the quality and robustness of contractual fallbacks for derivative contracts will be key.

The technical matter of fallbacks…

The importance of robust fallbacks was highlighted in the latest Financial Stability Board’s (FSB) progress report issued in November 2018, in order to limit the risk of discontinuation of benchmark rates.

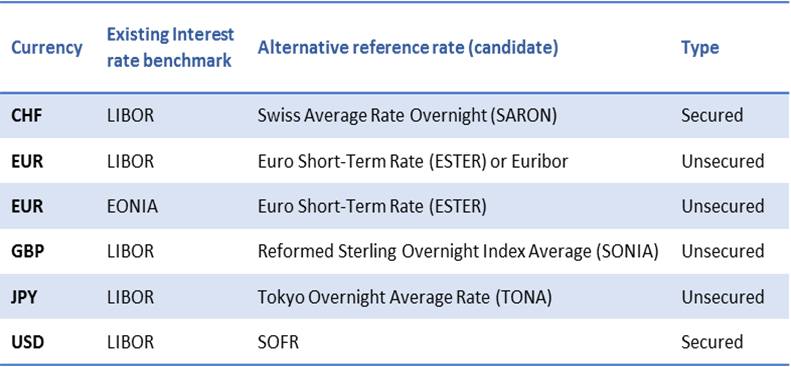

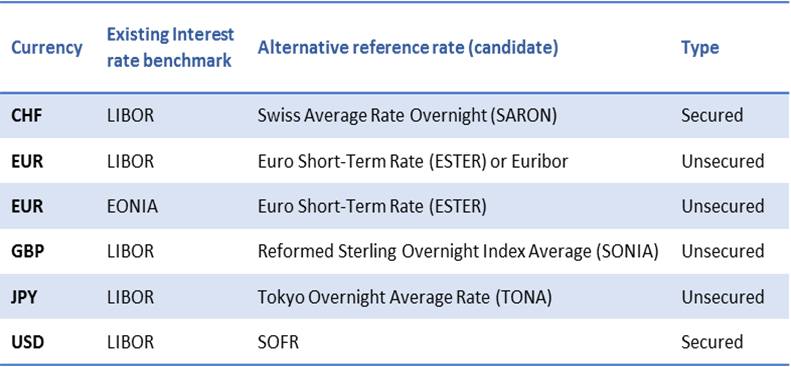

While determining robust fallbacks for contracts that reference certain Inter-bank Offered Rates (IBORs) is of major importance, it is also a very technical and sensitive topic. Indeed, even though alternative RFRs have been identified for most LIBOR currencies, technical issues have emerged from the very nature of these alternatives which, unlike the IBORs, are overnight rates – hence without any term structure – and risk free rates. As a result of these technical concerns, consultations led by the International Swaps and Derivatives Association (ISDA)[1], the European Money Markets Institute [2], the European Central Bank and the national working Groups are being gathered to reach a consensus on how future RFRs and spread adjustments are to be combined as replacements for LIBOR.

In July 2018, ISDA launched a consultation on methodologies for adjustments (term fixings, credit spread) that would apply to the fallback rates. According to the results of this consultation published in December 2018[3], the ‘compounded setting in arrears rate’ is the preferred methodology to build the RFR term structure, together with the historical mean/ median approach to determine the credit spread adjustment.

Based on these preferred approaches, ISDA will proceed with further developments and clearer definitions of standards. Alongside feedback from independent advisors, further consultation with market participants is anticipated in first half of 2019.

Specific consultations will be carried out on US dollar LIBOR, EURO LIBOR and EURIBOR in order to obtain the market consensus on the methodological solutions envisaged.

Securing contractual fallbacks is the key towards a smooth transition. However, the definition of fallback triggers may also be as important as the fallbacks themselves. One of the options mentioned by Mr Latter would be a representativeness test of the existing benchmark. Fallbacks would be triggered once the LIBOR does not satisfy this test and the unrepresentativeness of the existing benchmark is announced by the regulator. Discussions regarding potential fallback triggers are still at an early stage and need to be refined to avoid any “cliff-effect”, which could lead to Profit and Loss (P&L) leap; hedge ineffectiveness – in particular if the underlying instrument is not subjected to the same trigger – or margin calls etc. In such situations, institutions will be challenged on their ability to implement the appropriate processes in order to switch from the current benchmark rates to the RFRs.

Looking ahead

Without doubt the journey towards the end of LIBOR will be long and challenging, but progress has and is still being made: The existing methodologies and framework for IBORs have been strengthened, a fair number of alternative RFRs have been identified and plans to transition towards these alternative rates are emerging. In 2018, transactions referencing alternative RFRs have started to be observed. In the US, the Interest Rate Derivatives (IRD) traded notional referencing RFRs represented 3.4% ($ 8.1 trillion) of total IRD traded notional. Not surprisingly, those transactions were mainly Sterling Overnight Index Average (SONIA) transactions ($8.0 trillion), which is the current reference rate for sterling overnight index swaps[4].

However, successfully transitioning from LIBOR requires collective efforts from all market participants, including trade associations and regulators. While the UK and US regulators have been very “vocal” about LIBOR reform – the former even asking for a Board-approved risk assessment and transition plan – the levels of involvement from regulators across national jurisdictions remain varied.

Given the massive LIBOR-related trade volume involved across different asset classes, assuming that LIBOR may still be published for all asset classes when assessing the potential impacts and planning the transition might just increase the risk carried. Indeed, while cash products are highly LIBOR-dependent, the need for reforming the benchmark remains both undisputed and unavoidable and derivative contracts will not benefit from any preferential treatment in that matter.

Finally, while legal, valuation, accounting and model risk management are examples of areas that will be significantly impacted by the reform, the challenge will also be operational. Identifying all systems and data flows that involve LIBOR referenced contracts, managing multi-curves, switching from LIBOR to the fallback rates, developing or updating the current infrastructure along with new processes and controls, are key operational challenges that should not be underestimated.

| What about the EURIBOR reform? Concomitantly the European Money Markets Institute (EMMI) has been working on the EURIBOR reform. In particular, the development of a hybrid methodology composed of a three-level waterfall model. As part of the EURIBOR reform and, since the 3rd December 2018, individual panel banks’ submissions towards the determination of the EURIBOR benchmark will no longer be published and tenors of 2 weeks, 2 months and 9 months EURIBOR will be ceased.

The publication of the EURIBOR calculation under the ACT/365 and 30/360 day count, which was also supposed to be withdrawn early December 2018 has been extended until end of March 2019. The extension was granted in order for stakeholders to prepare their systems and contracts to accommodate changes. However, with the final EURIBOR methodology not yet stabilised – the results of the 2nd consultation on the final methodological blueprint are much anticipated in the first half of 2019 – concerns are rapidly growing about the ability to implement. |

[1] http://assets.isda.org/media/04d213b6/db0b0fd7-pdf

[2] https://www.emmi-benchmarks.eu/assets/files/D0373B-2018%20Second%20Consultation%20Hybrid%20Euribor_full.pdf

[3] http://assets.isda.org/media/04d213b6/db0b0fd7.pdf

[4] ISDA – January 2019 – Interest Rate benchmarks review : Full Year 2018 and the Fourth Quarter of 2018