Perspectives | 27 November 2019

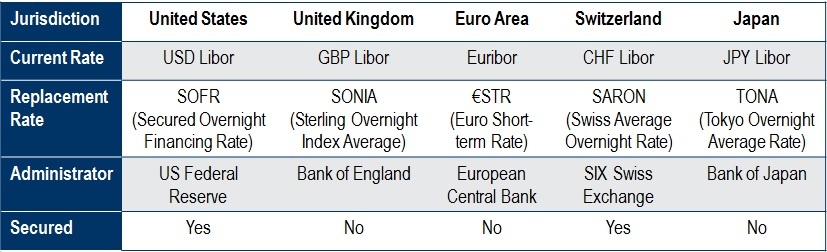

With little more than two years to go, Libor’s cessation date continues to near. The voluntary agreement of panel banks submitting to Libor will conclude at the end of 2021, from which risk-free rates (RFR) are expected to replace Libor and similar indices.

Are corporates

paying enough attention to Libor updates?

Libor’s

cessation should be of concern to many – if not all – market participants: financial

institutions and corporates alike. Banks, asset and wealth managers, insurers,

retail banks, building societies and mortgage lenders, and other financial

intermediaries are likely to have primary exposure to Libor-linked products,

however, corporates should also be aware of Libor consultation updates. Product

hedges, debt issuances, credit lines, and any other Libor-linked exposures may

pose risks across firms’ business lines and strategies.

Libor

underpins a variety of fixed income products: notably mortgages, commercial and

personal loans, bonds, securitisations, and derivatives. The move to RFRs means

all products firms may hold on or off their balance sheets are susceptible to

IBOR transition risks.

The

FCA expects Senior Managers and boards to understand the risks associated with

Libor transition. Senior management should act to transfer exposures to RFRs

ahead of the Libor cessation date. This means firms need to implement a robust

governance in their risk mitigation arrangements, including the identification and

appointment of Senior Manager(s) with the relevant expertise and

responsibilities of overseeing Libor transition under the FCA’s Senior Managers

and Certification Regime (SM&CR).

Senior Managers and their firms need to approach Libor transition with potential conduct risk in mind.

Senior

Managers and their firms need to approach Libor transition with due diligence

and care to identify and transfer their Libor-linked exposures to RFR in a

timely manner, bearing in mind the potential conduct risk. Although the FCA

does not have a strict definition of conduct risk, in its Retail Conduct Risk Outlook 2011 report, the FCA referred to

conduct risk as ‘…the risk that firm behaviour will result in poor outcomes for

customers’.[1]

Conduct

risk may emerge in a variety of ways, however, in the context of Libor transition,

is more likely to emerge from a lack of preparation in the identification of

Libor-linked products and slow implementation of a robust IBOR-fallback plan.

There is no one-size-fits-all framework for conduct risk, so the onus is on

firms to define their conduct risks and carry out regular reviews to ensure

their definitions continue to be fit for purpose.

In

their recent publication ‘Conduct risk during LIBOR transition’,[2] the FCA stipulated guidance for replacing Libor with the SONIA RFR in existing

contracts and products. To ensure firms continue to operate effectively and

maintain their responsibilities toward clients, firms need to:

- Amend existing contracts with robust fallback provisions and/or

convert the contract to reference the appropriate RFR

- Manage the liquidity of the Libor-pegged instrument and prepare

for the risk of insufficient transaction data in building out the rate curve

- Ensure clients are treated fairly throughout the transition

process, specifically with regard to the contract amendment process

- Maintain consistent and continual communications with relevant

stakeholders throughout the transition process

- Engage further with clients and stakeholders to keep them aware as

well as provide education on general provisions and timings of the Libor

transition roll-out

- Aim to issue new RFR-linked products

- Understand any and all issues which may relate to SONIA-issuance,

from legal papering to calculation methods

- Overarchingly, act in the best interest of their customers and

maintain high standards whenever and wherever possible

Additionally,

the FCA’s conduct risk guidance underscores the imperative for firms to

continually act in best interest of their clients. Remaining aware of the

pitfalls of IBOR transition are essential to maintaining clients’ best interests,

and the FCA has made it clear it will challenge instances where they believe

firms may be taking advantage of or, treating their clients unfairly.

However,

upsides in the transition process are possible for firms who do understand the

requirements of IBOR transition measures. For example, opportunities will come

to fruition as firms who get ahead develop new products to meet client needs.[3] To

ensure success in this regard, it is imperative for firms to acknowledge the

importance of early mover advantage in building out their Libor transition

programmes.

The

Libor transition poses a significant hurdle for market participants, who face a

variety of risks and significant cost in transitioning their Libor exposures to

SONIA – or any other RFRs. Although

retail or corporate clients may prefer their financial institutions to provide

comprehensive and aggregated information regarding each clients’ individual

Libor-linked exposures, such work can be exceedingly challenging – if not

impossible – for financial institutions to deliver. Some of the reasons may be the

existence of regulatory or legal requirements, such as Chinese walls between

different businesses, (e.g. investment banking and trading businesses), legal

and regulatory differences across jurisdictions, etc.

All firms with Libor-linked exposures need to engage and develop appropriate guidance to meet the challenges ahead. They should be continually assessing their obligations, both to their clients and to their own business strategies. Additionally, ensuring that there are records of appropriate due diligence being continually performed is a must as, the FCA will likely challenge how institutions have considered mitigated conduct risk in the lead-up to IBOR transition. To conclude, at any point in time during the transition period, firms should keep in mind that they have a fundamental obligation to act with ‘due skill, care, and diligence’ to ensure conduct risk is minimised throughout firms’ IBOR transition.

Article written by Sophia Chiang (Associate at Mazars UK)

[1] https://www.fca.org.uk/publication/business-plans/fsa-rcro.pdf

[2] https://www.fca.org.uk/markets/libor/conduct-risk-during-libor-transition

[3] https://www.icaew.com/technical/financial-services/financial-services-faculty/fs-focus-magazine/previous-editions-of-fs-focus/fs-focus-2019-issues/june-2019/libor-transition-what-firms-need-to-do-and-what-are-the-risks