Perspectives | 7 February 2019

With rising global temperatures[1] comes an ever-growing pressure on the financial services sector to respond and prepare for the far-reaching effects of climate change. The impacts upon the sector are already being felt – extreme weather events are creating significant losses for insurers and credit risks for banks, and pressures on businesses to demonstrate sustainable businesses and incorporate ‘green finance’ are forcing firms to adapt their business models. The FSB, PRA and FCA have also each had their say in how companies should be adapting and managing their exposure to climate change risks.

So what are the key developments to date and how should the financial services industry be responding?

How does climate change impact the financial services sector?

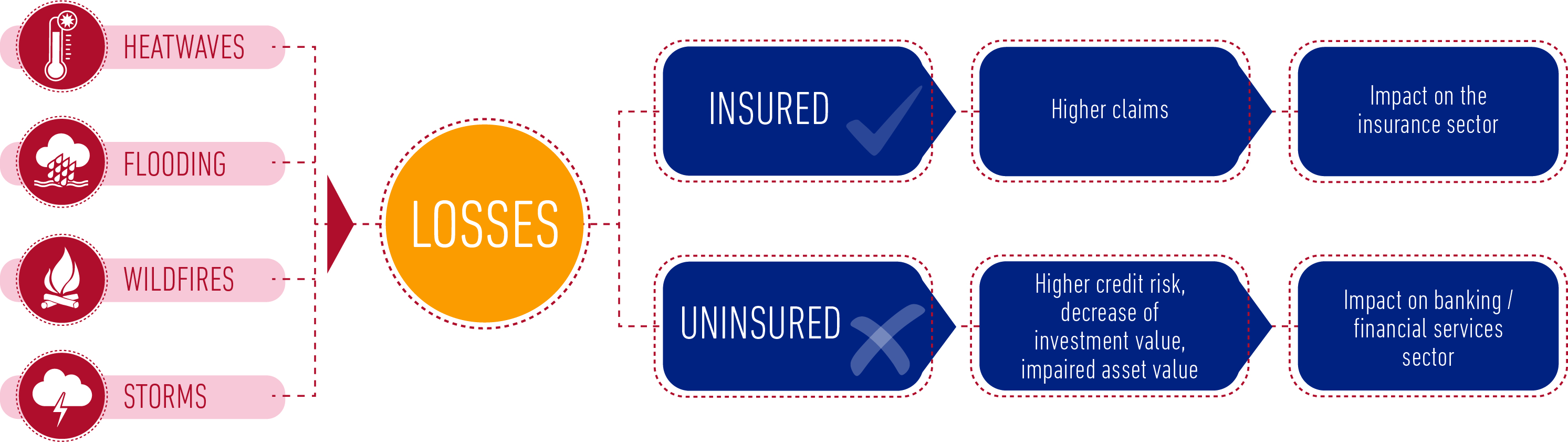

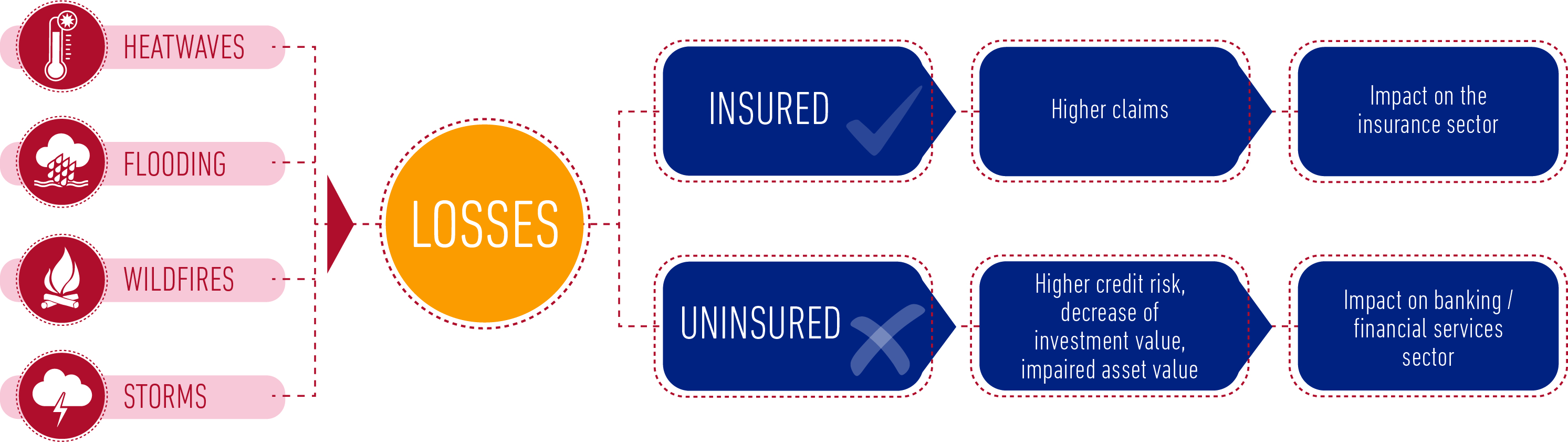

Physical risks

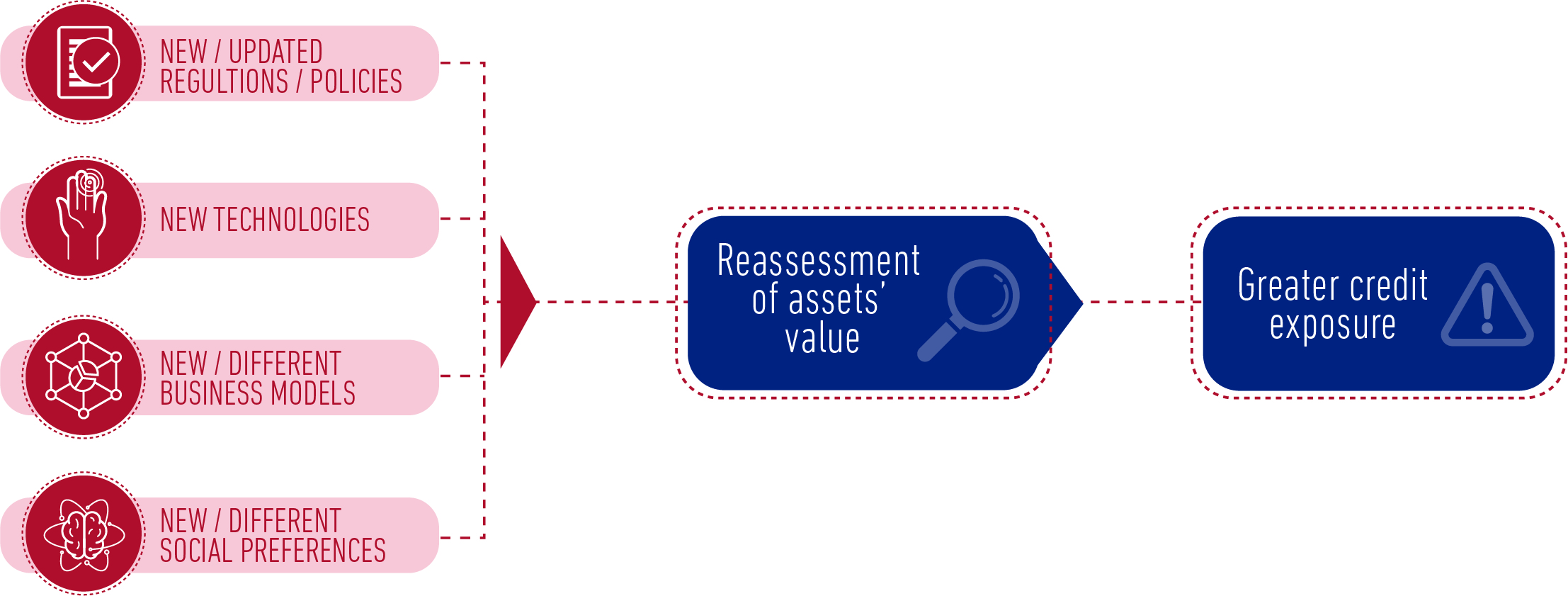

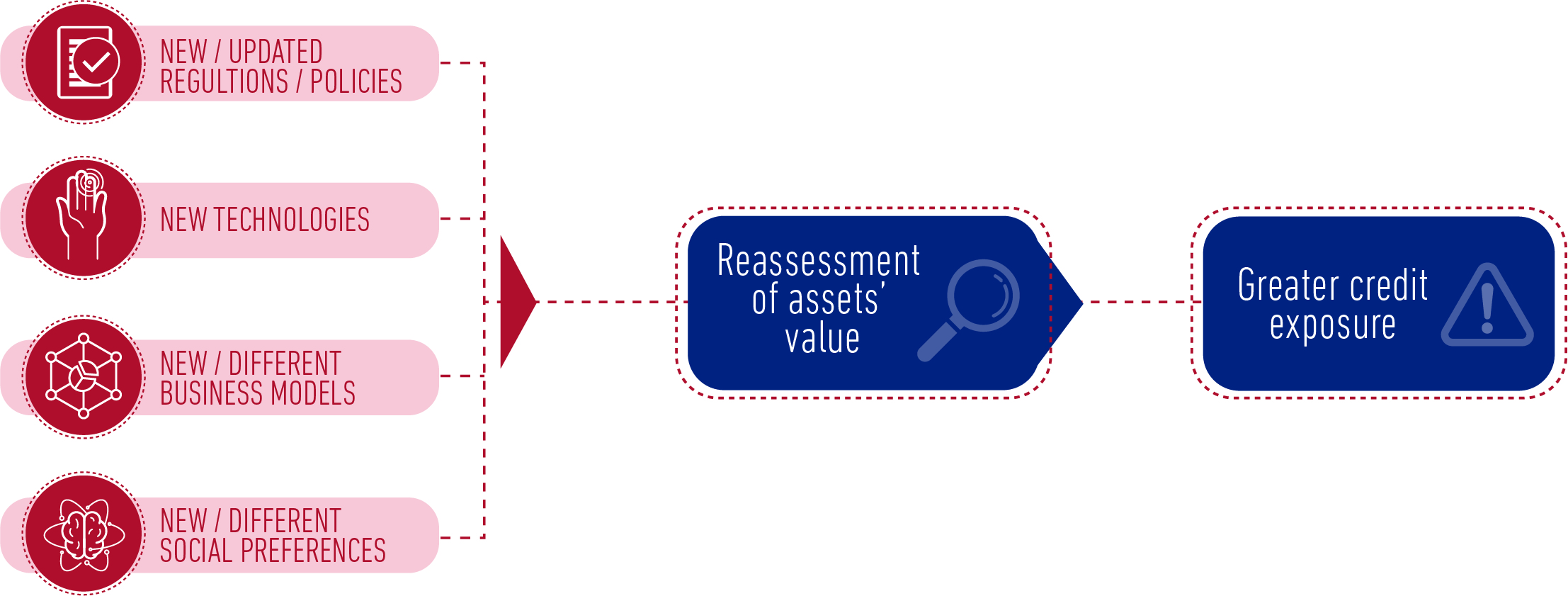

Transition to a low carbon economy

Although the impact of the transition to a low carbon economy, partly driven by the Paris Agreement[2], will be seen more directly within the fossil fuel and utility sectors, there will be a huge indirect effect on many others including energy-intensive sectors. In the financial services, the consequences will mainly be felt by financial institutions who have exposure to firms within these directly affected sectors.

Transition related financial risks

How have the regulators responded to date?

Taskforce on climate-related financial disclosures status report

Recognising the criticality of climate change not only for the environment but also for businesses and the economy as a whole, the Financial Stability Board (FSB) created the Task Force on Climate-related Financial Disclosures (TCFD) in 2015. The TCFD’s final report was issued in 2017 with a number of recommendations to help firms identify climate-related risks: through better disclosures, helping market participants better understand and assess their risks and exposures, as well as recognising opportunities and recommending areas of improvement.

The Prudential Regulatory Authority (PRA) consultation paper

In October 2018, the PRA issued a consultation paper seeking views on a draft supervisory statement on “banks’ and insurers’ approaches to managing the financial risks from climate change”. In line with the TCFD approach, the proposals aim to outline effective ways to address financial risks arising from climate change.

How banks and insurers should be managing financial risks

- Governance: The consideration of financial risks arising from climate change should be part of firms’ governance frameworks and, in order to ensure adequate oversight, senior management and board members should be held accountable.

- Risk management: Firms will be required to identify, monitor, measure, manage and report on their exposure to these risks through their risk management frameworks.

- Scenario analysis: Firms will be expected to use scenario analysis in order to measure the potential impacts of climate change-related risks in the context of their strategic plans.

- Disclosure: Firms should consider whether the existing Pillar 3 disclosure rules on material risks will suffice or whether additional disclosures need to be put in place in order to better inform market participants.

The consultation closed on 15 January 2019. Next, the PRA will publish a Supervisory Statement to set out the rules to manage financial risks arising from climate change, in line with the results of the consultation. At the time of writing, we do not have a date for publication.

The Financial Conduct Authority (FCA) discussion paper

In parallel to the PRA, the FCA also launched a discussion paper in October 2018 on “Climate change and Green Finance”. Recognising the growing demand for green products, particularly in asset management and retail banking, as well as the need to identify and manage climate-related financial risks, the FCA identified four priorities that require regulatory development:

- Pension investments – considering the long-term nature of these investments, they will most likely be particularly affected by climate change.

- Innovation – firms are encouraged to develop specialist green products whilst, at the same time, ensuring the good functioning of markets and outcomes for consumers.

- Issuers of securities admitted to trading on a regulated market – entities falling under this category should give adequate and appropriate information to investors, allowing them to make informed decisions.

- Public disclosure on climate-related risks – financial services firms should report publicly on how they manage climate-related risks. This requirement stems from TCFD’s recommendations mentioned above. The disclosure aims to deliver transparency as well as to assess the areas with greater risk exposure and thus recognise any needs for further improvement.

Responses and feedback on this discussion paper are being requested until 31 January 2019.

Mazars’ commentary

The regulatory focus on sustainable finance and climate related-risks and issues will likely grow stronger in the coming months and years. Customers and the wider public express greater demand for ‘greener businesses’, a vast majority of the world’s public authorities are committed to tackling climate change and the financial regulators have started setting their expectations around risk management and governance. All these elements are setting the stage for increased transparency, regulation and necessary adoption of new business practices. Enhancements to the risk-management approach, including the risks arising from climate change, is already taking place, however, more needs to be done in this area. Firms will be required to take a more strategic approach and analyse how actions in the present can impact future financial risks.

To be better prepared for aligning their risk management and governance frameworks when the final requirements are issued, firms should begin to identify the climate-related risks that are tied to their individual business profiles and assess their magnitude. One of the key challenges of course will be the lack of reliable data to build models for estimating future climate change impacts.

Developing robust risk management frameworks around climate change will require long term efforts and continuous improvement as firms learn from their individual experiences and peers. The sector must be ready as this ever-present issue becomes routed in the business agenda and sustainable approaches become more critical to long-term success.

Article was written by Dharmina Chimanlal, Manager – Regulatory Affairs, Mazars UK.

Sources:

Consultation Paper 23/18 (Prudential Regulation Authority) Enhancing Banks’s and Insurers’ approaches to managing the financial risks from climate change – October 2018

Financial Conduct Authority’s Discussion Paper 18/8 on ‘Climate Change and Green Finance’ – October 2018

Task Force on Climate-related Financial Disclosures Status Report – September 2018

Forbes article: “Exactly How Much Has the Earth Warmed? And Does It Matter?” – September 2018

[1] According to an ongoing temperature analysis conducted by scientists at NASA’s Goddard Institute for Space Studies (GISS), the average global temperature on earth has increased by about 0.8° Celsius (1.4° Fahrenheit) since 1880. Two-thirds of the warming has occurred since 1975, at a rate of roughly 0.15-0.20°C per decade.

[2] In 2015, representatives from nations across the world signed the Paris Agreement. The agreement, which came into effect in 2016, builds upon the United Nations Framework Convention on Climate Change and brings together more than 195 parties (as of November 2018). The agreement aims to keep the global temperature rise this century well below 2 degrees Celsius compared to pre-industrial levels. Signatory parties have agreed to go even further and work towards decreasing temperatures by 1.5 degrees Celsius.