Perspectives | 11 March 2019

Following a majority vote against Theresa May’s Brexit deal on 15 January 2019, and with only 3 weeks until the proposed deadline of 29 March, financial services authorities in the UK and EU have been urgently preparing for an increasingly likely no-deal Brexit, announcing further transitional instruments and offering guidance to firms within the sector. Since our last article, several updates have been announced and further negotiations have taken place.

One of the key issues for the authorities is securing the continuation of information sharing between the UK and the EU 27 after the 29th March. Firms in both the UK and EU27 are still relatively unclear on how the sector will fair after the UK’s departure, with Joachim Wuermeling, Member of the Executive Board of the Deutsche Bundesbank, summarising on 14 February 2019; “The future regime under which banks and companies in general will operate after 29 March 2019 remains unclear. And whether we like it or not, a hard Brexit has become increasingly likely.” This installment of ‘Brexit Watch’ will address the focus on information sharing and transitional powers, as well as outlining the most important developments to key EU regulatory regimes.

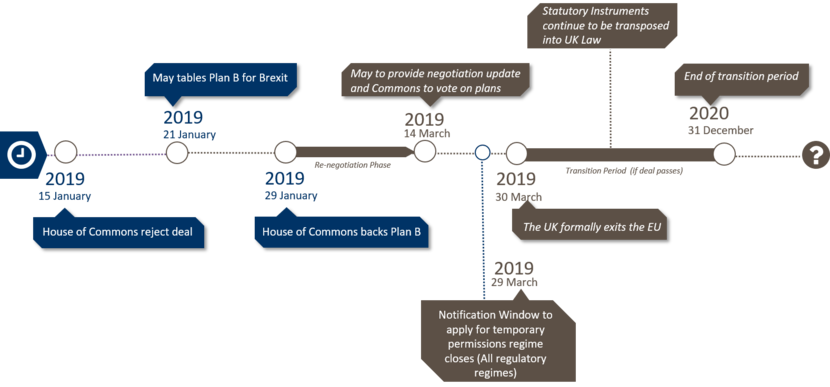

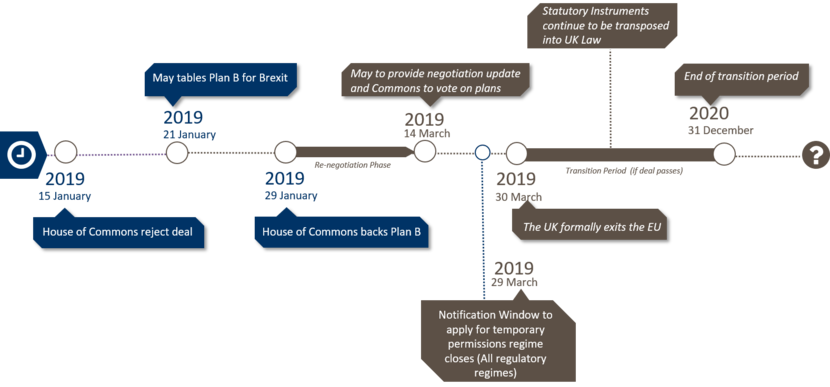

Timeline

The timeline below highlights the trajectory of developments since January 2019.

Will UK/EU information sharing continue post Brexit?

One of the main objectives for this extensive contingency planning post-Brexit is to enable financial services firms to continue service in a coordinated and least disruptive manner. Hence, there is a key focus on the continuation of information sharing between the UK and the EU in the event of a no-deal Brexit.

The European Securities and Markets Authority (ESMA) has announced on their Brexit webpage that it is “essential that EU securities regulators can continue to meet their mandates regarding investor protection, orderly markets, and stability”. In order to fulfil this expectation, ESMA have held negotiations with both the Financial Conduct Authority (FCA) and the Bank of England (BoE) in February 2019, in order to agree Memoranda of Understanding (MoUs) to ensure important supervisory information can continue to be exchanged after 29 March.

On 4 February 2019, the BoE announced these results. The Bank explained that the MoUs have been agreed so that from 30 March, if there is a no-deal Brexit, ESMA will continue to recognise UK central counterparties (CCPs) and central securities depositories (CSDs), to enable them to continue to provide services within the EU. Similarly, the FCA has also pressed for continued “cooperation and exchange of information” in the event that there is no withdrawal agreement or implementation period following the UK exit. The main agreement, announced on 1 February, between ESMA and the FCA is regarding the supervision of credit rating agencies and trade repositories. The FCA has also had negotiations with national regulatory authorities within the EU and EEA to further facilitate the continuation of information exchange, agreeing a multilateral MoU. The smooth continuation of information sharing is vitally important for financial stability within the sector during the transitional period and will remain a top priority for the authorities.

Will there be a continuation of delegation?

As part of these agreements, EU and UK regulators have also settled on a deal regarding the permission of UK funds to be domiciled and regulated in a different EU country, known as delegation. Asset managers in the UK have been anticipating these negotiations, as a large amount of European retail funds are currently run by UK fund managers but domiciled in other EU countries such as Luxembourg or Ireland. The current regulation, the Undertakings for Collective Investment in Transferable Securities Directive (UCITS), allows delegation to be undertaken, provided there is an agreement between ESMA and the regulator of the fund manager. Despite concerns that Brexit may disrupt this understanding, the continuation of delegation has been agreed within the MoUs between UK and EU regulatory bodies to ensure the continuation of cross-border portfolio management.

How will the regulators ensure a smooth transition?

In addition to the aforementioned agreements, a variety of additional transitional powers have been put in place to facilitate an exit, with minimal disruption to financial services. On 23 January 2019, a letter from the HM Treasury Economic Secretary to the Treasury was published. The letter outlines the proposed transitional powers for the Prudential Regulation Authority (PRA), FCA and BoE if no withdrawal agreement is put in place. Similarly to the MoUs, these powers will enable the regulatory bodies to gradually phase in new requirements that result from Brexit, to minimise disruption to the provision of financial services in the UK and EU. These powers are intended to be supplemental to the Temporary Permissions Regime (TPR), which opened on 7 January 2019 for firms currently relying on EEA passport rights/ treaty rights to continue providing services in the UK for a period of up to 3 years after exit day. In order to apply for this regime, firms will need to notify the regulator prior to exit date.

However, there are several aspects of the regulatory framework which the regulators expect firms to prepare for themselves. The FCA has made it clear that there are some aspects in which it would not be consistent for them to grant transitional relief. These include firms subject to MiFID II transaction reporting regimes, firms subject to EMIR reporting obligations and EEA Issuers that have securities traded on UK markets. Regulated firms should ensure they have provisions in place in order to comply with immediate changes to these areas, come exit day.

Moreover, to further aid a smooth transition, the European Banking Authority (EBA) has published further guidance surrounding deposit guarantee schemes in the event of a no-deal Brexit. On 1 March 2019, the EBA released its opinion on the Deposit Guarantee Schemes Directive (DGSD) and the impact Brexit will have on protection within the EU. The EBA has announced that DGSD Authorities within the EU should put provisions in place to ensure that depositors in EU branches of UK credit institutions are adequately protected by a deposit guarantee scheme, in the event of the UK leaving without a withdrawal agreement. This follows the BoE’s confirmation on 28 February that EU branches of UK banks will no longer be protected by the UK’s Financial Services Compensation Scheme after exit day. The EBA has recommended that these branches of UK banks take the necessary steps to become members of local Deposit Guarantee Schemes within the EU, to ensure depositors stay covered.

On 28 February 2019, FCA issued ‘near final’ rules and Brexit Policy Statement alongside detailed Transitional Directions for EEA entities. The policy statement highlighted that further changes to the Binding Technical Standards should be anticipated in lieu of bilateral negotiations. Final instruments are expected to be released on 28 March 2019. Despite the uncertainty, the FCA has ensured that EEA firm servicing UK consumers will be granted a transitional period with exceptions to firms looking to set up new business hubs in the UK. The first landing slots to apply for comprehensive authorisation for inbound passporting firms is slated to be released in October 2019.

We have highlighted below some of the key regulatory regimes that will be particularly affected by the UK’s departure from the EU.

How will Brexit impact the UK Regulatory Regimes?

Capital Requirements Regulation (CRR)

The CRR Statutory Instrument (CRR SI) amends the original CRR regime and shall be applied should the UK leave the EU without an agreement in place. There are several changes foreseen such as:

•The preferential rate of 0% risk weight will no longer apply to exposures of UK firms to EU sovereigns, however, should the UK be formally ‘equivalent’ for this purpose, it could still possible

•The basis for calculating consolidated capital and capital requirements for some groups will be different

•Changes to the liquidity regime for UK banks, including eligible assets for liquidity purposes will also take place

So, what will remain in the UK from the original CRR regime?

•Capital regime for exposures of UK banks/ investment firms to UK and EU CCPs

•EU style regime granting temporary relief for exposures to non-EU CCPs

European Markets Infrastructure Regulation (EMIR)

In relation to the UK version of EMIR, the following points are to be highlighted:

•HMT has proposed that EEA firms will no longer be regulated under a uniform cross-border regime and will be subject to independent EMIR equivalent SIs to be transposed into UK law after exit day

•EU regulated markets are not ‘equivalent third country markets’ as they have not been considered equivalent under the UK EMIR regime

•ESMA has announced continued recognition of the three largest UK clearing houses, LCH, ICE Clear Europe and LME Clear, giving EU traders continued access

Markets in Financial Instruments Directive and Regulation MiFID/ MiFIR

Key points to highlight:

•ESMA’s functions will transfer to UK regulators (including powers for FCA and PRA to make binding technical standards (replacing RTS) and EU Commissions’ powers to transfer to HMT (including powers to make equivalent decisions)

•EEA countries will be treated as any other non-UK jurisdiction countries (although some exceptions apply)

•In relation to Transaction reporting, the instrument scope remains unchanged (instruments admitted to trading or traded on UK or EU trading venues and related)

Conclusion

Exit day is soon approaching and political position hasn’t changed much from previous months. Will the UK manage to secure an agreement with the EU or will a ‘no-deal’ be the UK’s new reality? This is the question in everyone’s mind. The ‘no-deal’ scenario is starting to be seen as a likely outcome although the UK government is still trying for a deal.

In coming weeks, banks will continue engaging with supervisory authorities in order to secure licenses that are relevant to their business models, and avoid any disruption to cross-border services after exit day. Banks will also continue focusing on the status of their contractual obligations and ensure contracts affected are re-papered in a timely manner.