Interviews | 13 July 2016

Customers trust their banks with an increasing amount of data that paints a picture not just about their financial situation and preferences, but about their lifestyles. Bank of Ireland’s Garvan Callan, Director, Customer, Digital & Innovation talks to Liam McKenna Partner, Consulting Services – Mazars Ireland, about how ethics and good principles are essential in shaping the way banking data is used in future.

Liam McKenna: Technology now gives the capability to collect huge amounts of data. How do you balance the bank’s need for the collection and use of data so that it also remains in the customer’s interests?

Garvan Callan: It’s a very real conversation we are having and one that involves the entire organisation truly understanding what we are trying to do from the customer’s perspective and how the use of data can contribute. As a result, we are challenging ourselves with some pretty demanding targets around giving wider support to the customer and we’ve got a number of ongoing projects that are helping us achieve those targets. Key to this is helping our customers to become financially confident through proactive care. Proactive care is not just about meeting banking needs when the customer requests it, but looking at how we can get ahead of that in order to improve the customer experience. For example, we now have the capability to analyse our customer data and send a text if a debit is coming out that will exceed a customer’s credit position. We have then taken this a step further by offering customers information on the impact of costs and penalties and how to avoid them by guiding them to micro-sites that help them manage their money smarter. This also helps from a commercial perspective as these fees are not a commercial line, they simply help pay the cost of inefficiencies that arise when, say, resubmitting a direct debit. So it also works in our favour if we can use data to alert a customer regarding a potential event enabling them to act on that information in advance of a problem occurring.

Liam McKenna: How do you control such data from an ethical perspective?

Garvan Callan: There is a risk that data can be used to push products or messages indiscriminately. But that’s not our model. The driver for us is to improve the customer experience. We’d rather win the right to offer appropriate products and services by using our data intelligence to create a positive experience. We see it as a value exchange whereby we use data entrusted to us to help our customers become financially confident. It creates a secure relationship with our customers that empowers them to be in control of their financial choices, which is what we believe becoming financially confident is all about.

Liam McKenna: Now that mobile banking transactions are exceeding all other banking channels, how do you manage the development of technology with traditional banking needs?

Garvan Callan: We know that technology is changing the way people bank at a rapid pace. But it’s important to get the balance right and our ability to capture data gives us key insights into how people bank and their particular needs. So we know that having a physical presence continues to be important, but it’s a question of using that investment to reach into and engage the market. So rather than branches being transaction centres, they become support hubs for community, enterprise and customer engagement. For example, we have used our insights into the tech sector to repurpose some branches to become business development centres whereby start-ups can come in and use our Workbench facility to network, get advice or simply work in a campus style atmosphere. It’s an approach that uses old style bricks and mortar banking to create a stronger local market environment, which leads to a stronger economy and helps foster better opportunities for us all. So by adopting a proactive customer engagement approach and rethinking how we can use our assets we are creating a positive customer experience across all channels.

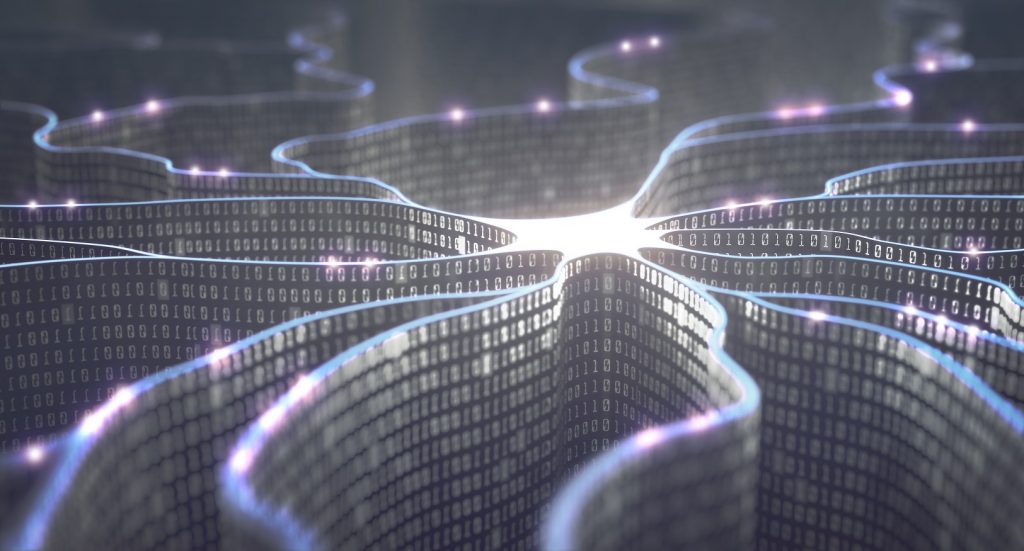

Liam McKenna: What success have these new initiatives had so far and how do you see the use of data developing?

Garvan Callan: So far our initiatives have been a phenomenal success and we plan to build on that. For example, with our strong data intelligence on small to medium businesses we are developing online simulators to help businesses assess growth projections or benchmark themselves against their peers, plus the success of our Workbench initiative has already led to us building a start-up lab and formal incubator site in Galway. Since our Workbench facilities opened last year we have welcomed more than 10,000 visitors, hosted more than 200 events, and supported more than 100 startup enterprises.

On the mobile app side, we are exploring best practice on how geo location services can help customers optimise financial outcomes when travelling and avoid cyber threats. While we continue to test and analyse the market place we place considerable emphasis on the spirit of compliance so are committed to using data sensitively and responsibly to create initiatives that win us the right to repeat activity with the customer. Importantly, we make sure any insights enrich our internal processes so we understand their impact across the entire organisation enabling us to build data capabilities around value exchange and continually professionalising staff to implement our proactive care approach. As the financial sector’s ability to gather more data increases we have to consider the potential consequence of misusing the data versus increasing touch points with customers. By acting responsibility with data we believe we can develop an open engagement with customers for the betterment of everyone in the exchange.